There's loads of interesting info in Sony's PlayStation investor relations document

Numbers! Growth vectors! More!

There's a lot more to Sony's PlayStation investor relations document than confirmation Uncharted 4 is coming to PC.

The document, published as part of Sony's 2021 investor relations day, focuses on the company's Game & Network Services Segment. It's penned by PlayStation boss Jim Ryan, and includes a number of interesting bits of information that reveal Sony's masterplan for its money-printing video games business.

At the beginning, Sony mentions it's "building our biggest-ever platform" with PlayStation 5, and that it's working to ensure "our longest-ever tail" with the PS4. PS5 has delivered PlayStation's highest-ever launch sales, with 7.8m units sold as of the end of Sony's last financial year (ending March 2021).

For context, PS4 sold 7.6m in the same timeframe, PS3 sold 3.6m, PS2 sold 1.4m, and PSone sold 700,000. PS4 has 45 percent console market share, according to Sony. With PS5, it's targeting over 50 percent.

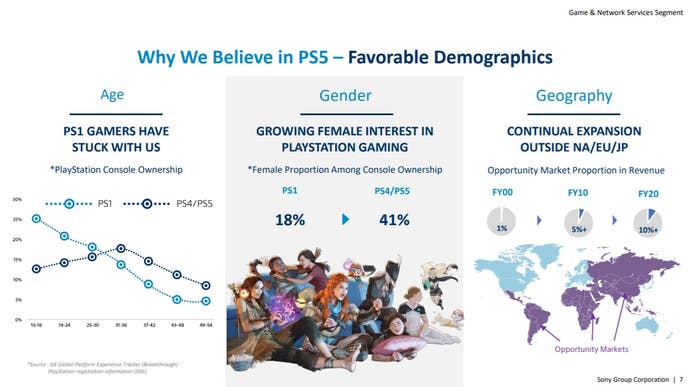

To this end, Sony points to "favourable demographics" that should ensure PS5 is a massive success. It reveals growing interest in PlayStation gaming among women, with the proportion of women among console ownership increasing from 18 percent with PSone to 41 percent with PS4 and PS5.

Here's an interesting one: we know Sony is currently selling PS5 at a loss. According to this document, Sony expects the PS5 standard edition to break even from June, and make a profit soon after.

As you'd expect, the real money is not made from the sale of consoles. Rather, it's from software, services and peripherals. During the 2020 financial year, consoles made up 20 percent of revenue, with software, services and peripherals making up 80 percent. During the 2013 financial year, consoles made up 48 percent, leaving 52 percent for software, services and peripherals.

Despite the focus on PS5, Sony says PS4 remains the key driver of PlayStation Store revenue, with strong new releases including Horizon Forbidden West. During the 2020 financial year, 95 percent of PS Store revenue came from PS4. Sony reckons for the 2021 financial year, that will drop down to 70 percent.

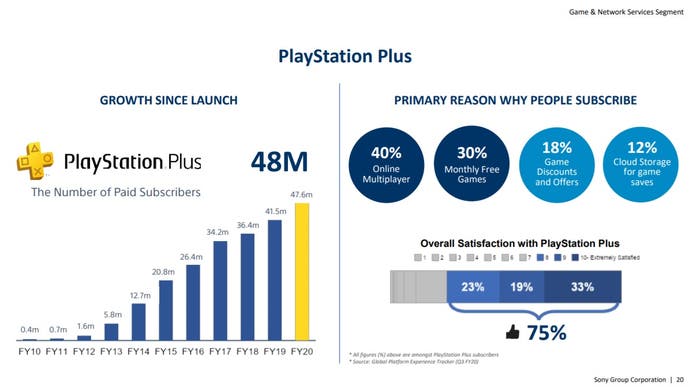

More figures! Sony has 48 million paying PS Plus subscribers, with online multiplayer the most popular primary reason for signing up (free games isn't far behind).

"New growth vectors" for Sony include doubling down on China, and increasing its direct physical retailing capacity (more on that later). There's also a "beyond console" approach. Again, more on that later.

Here's where things get really interesting: one of Sony's new growth vectors is PlayStation Direct, its direct hardware distribution channel that currently operates in the US only. The UK and Ireland are listed as part of the European expansion of this effort in the 2021 financial year. Hopefully this means we'll be able to buy a PS5 direct from Sony, sidestepping the retailers that have struggled with scalpers and bots since the console came out.

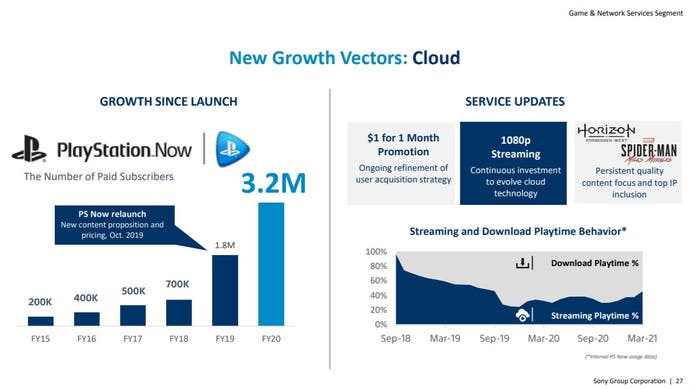

The cloud is another "new growth vector". Here we learn PlayStation Now has 3.2 million paid subscribers. Sony has so far resisted putting its big first-party games on PlayStation Now day and date, as Microsoft does with its first-party games and Xbox Game Pass.

Sony goes on to talk about "beyond console" - "a transformation from PlayStation's current consolecentric ecosystem to a future where large elements of our community extend beyond the console". There's no real detail here, but let's remember Sony's current PC push, and its upcoming mobile push.

It's worth poking around the document to get a sense of what Sony's trying to do with its games business now the PS5 is out in the wild. Other snippets include a slide on the next PSVR, its plan for PlayStation Studios (more partnerships and investment), it's plan for "games as a service" ("develop more service-led experiences within first-party roster; release both on and off console"), and the importance of free-to-play games such as Fortnite. It's fascinating stuff for anyone interested in the business side of the games industry - and paints a picture of a console maker in rude health.